Facing the Challenge of Maintaining Profit Margins During Times of Fluctuating Cost of Goods

It’s not easy to make money. That obvious statement is even truer for the foodservice operator that works on thin margins with little room for increases in cost of goods. 24% of operators consider staying on budget while maintaining profit margins to be their “biggest challenge” and another 27% consider it “a top challenge.” Typically, the profit margin pressure they are experiencing is coming from the cost of goods they are buying, not from the inability to grow their top line revenue.

Therefore, the foodservice manufacturer and their distributor are challenged to supply product to the restauranteur at a cost that works for all parties. Naturally, that is much easier said than done. The manufacturer and distributor have their own costs and need for profit margins, so passing along those costs to the operator becomes a necessity.

To help manufacturers utilize a pricing strategy in a standard selling and buying market, IFMA’s Consumer Planning Program Committee commissioned Datassential to execute research with 588 foodservice operators. The primary goals of the research included:

- Uncovering the pain points of having a balanced budget

- Determining which product categories operators are willing to a pay premium for

- Understanding how and why operators use specialty pricing

Unexpected Price Increases are a Top Challenge for Operators

The findings show that sudden and unexpected price increases are the top reason that operators point to for the budget challenges that they face. 63% of operators claim that unexpected price increases happen occasionally and another 25% say it happens all the time. Given the uncertainty of price increases, it’s almost impossible to have a planned-out budget if you cannot anticipate where the cost of items is going to go. This is further exacerbated by the fact that the items that tend to fluctuate the most are in the protein and produce categories – a typical operator’s most expensive buy. To help alleviate this pain point, its recommended that foodservice manufacturers and distributors provide as much notice as possible for an upcoming price increase. Or, in those instances when that is not possible, prepare your customer-facing people with a well thought out, fact-based explanation for the unexpected price increase.

Source: IFMA Consumer Planning Program from Datassential 2017

Trading in a Premium Product for a Value Product

Continuing to purchase products with preferred brands and attributes is another set of challenges that operators face when trying to maintain a balanced budget. Changing from a reliable product and/or brand is difficult because it can cause a disruption in the food preparation process or, in the case of front of house brands, in the patron’s perception of your operation. So, operators are cautious about switching, even if it means having to accept a price increase. Trading down might look good on the budget line, but could have a long-term negative impact if it hurts customer and/or employee satisfaction.

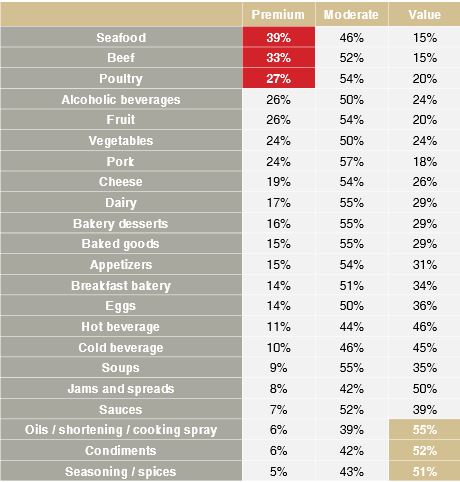

Accepting a lower price to improve one’s cost of goods sold is largely a reflection of the product category being purchased. Trading in a premium product for a value product is most pronounced in the jams & spreads, oils/shortening, condiments, and seasoning/spices categories. On the flip side, many operators are more willing to buy a premium product in the major protein categories like seafood, beef, and poultry. Alcoholic beverages, fruits, vegetables, and pork are other categories where at least a quarter of operators claim they are buying a “premium” product. Many categories fall into the “moderate” tier of quality which can mean many things to different operators. In the end, its recommended that manufacturers and distributors either have 1) quality and pricing tiers that meet the needs of many operators, or 2) focus on one side of the pricing spectrum, either premium or value.

Source: IFMA Consumer Planning Program from Datassential 2017

Operators Use Special Pricing and Sacrifice Profit Margins to Build Their Top Line

Operators are also looking for ways to use their own pricing levers to help drive traffic and frequency to their establishments. Almost half of operators, across segments, use specialty pricing to increase customer traffic, build loyalty, and drive frequency. Other goals of specialty pricing include building a value-driven perception, winning value-driven consumers, and driving traffic to underutilized dayparts.

Source: IFMA Consumer Planning Program from Datassential 2017

Operators are willing to sacrifice some margin to build their top line. According to one Casual Dining operator, “it raises food costs but helps us drive volume.” Another Casual Dining operator says, “it brings people to the restaurant so even though we’re losing money during the sale, we are creating new customers.” Partnering with an operator to drive trial, frequency, and loyalty is one lever that a manufacturer can use to develop a strategic relationship with a locally leveraged operator or a small, emerging chain. Offering them a product or menu idea with promotional pricing attached might have a short term impact on a manufacturers margins, but the long term growth could be well worth the investment.

Look for Opportunities to Work with Operators

Pricing will never be perfect and it will always be a mixture of art and science. But, for the foodservice manufacturer, its imperative to understand what pricing options operators want in your category. Then, work with that operator to find opportunities to manipulate pricing to drive more consumer interest and repeat visits to their establishment. Once a strategic partnership develops from this, trust follows, and soon pricing is no longer the basis of the relationship.