Many foodservice manufacturers have come to believe that the foodservice operator makes their purchasing decisions based on myriad factors they contemplate every time they place an order. While this is true for a number of operators, the majority of foodservice operators prefer their purchasing process be easy, streamlined, and repeatable. Only 27% of foodservice operators say they use careful consideration when placing a purchasing order. And 15% say they auto-reorder without even thinking about it. Placing purchasing orders does not drive business growth; instead, it takes time away from activities that actually help them grow their businesses.

Therefore, influencing operator purchasing decisions is not easy. Foodservice manufacturers need to take advantage of the channels that are available to them as they seek to gain more of an operator’s overall spend on products and services. Understanding operators’ motivations and triggers is therefore key to success.

Understanding the motivations and triggers of the foodservice purchasing process is one of the topics addressed in IFMA’s brand new publication titled, “The Modern Operator.” This report, conducted on behalf of IFMA by Datassential, surveyed 1,200 independent and self-managed foodservice operators on topics including sourcing preferences, purchase dynamics, influencers, product selection, and technology use. “The Modern Operator” report is the second major release of IFMA’s Food Future 2025 program, succeeding the Operator Landscape Portal which can be accessed at IFMAworld.com/operatorlandscape. Both the report and the Portal are now accessible for all IFMA members.

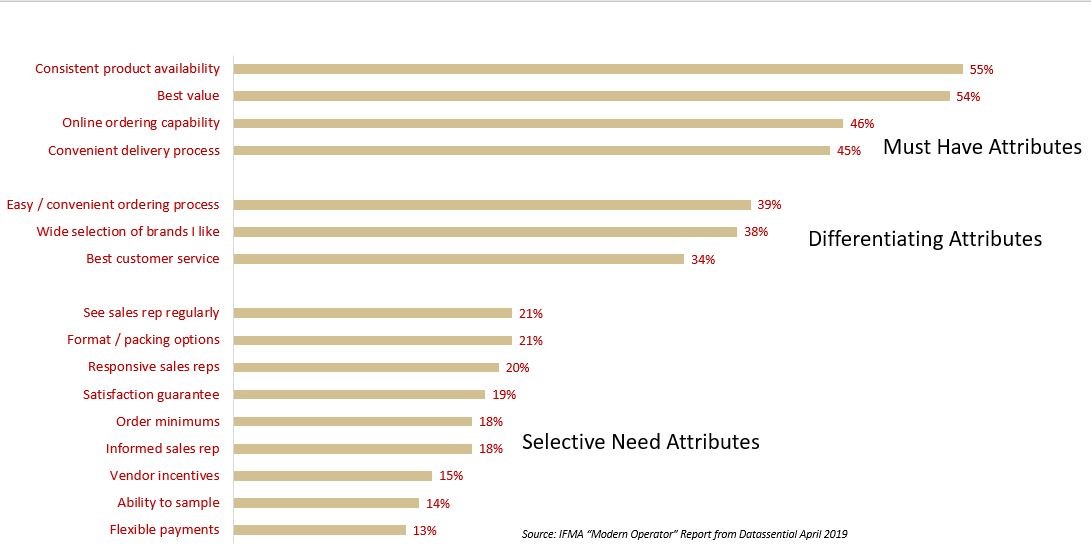

Operators that have the flexibility to choose their product source want consistent product availability and value above all else. Being able to order online and having a convenient delivery process are also factors that many operators want. These four factors are no longer a “nice-to-have”; they are essential for any foodservice distributor that wants to meet the needs of their customers.

Once an operator has committed to your product by making it a standard ingredient for their food offering, it’s vital to do the basics to keep it there. The number one reason operators switch to another product is when their incumbent product is no longer available. Only 39% of operators are going to switch because they found a cheaper alternative elsewhere. So, focus on keeping it stocked and available for purchase and worry less about how much your competitor might be charging for a comparable product.

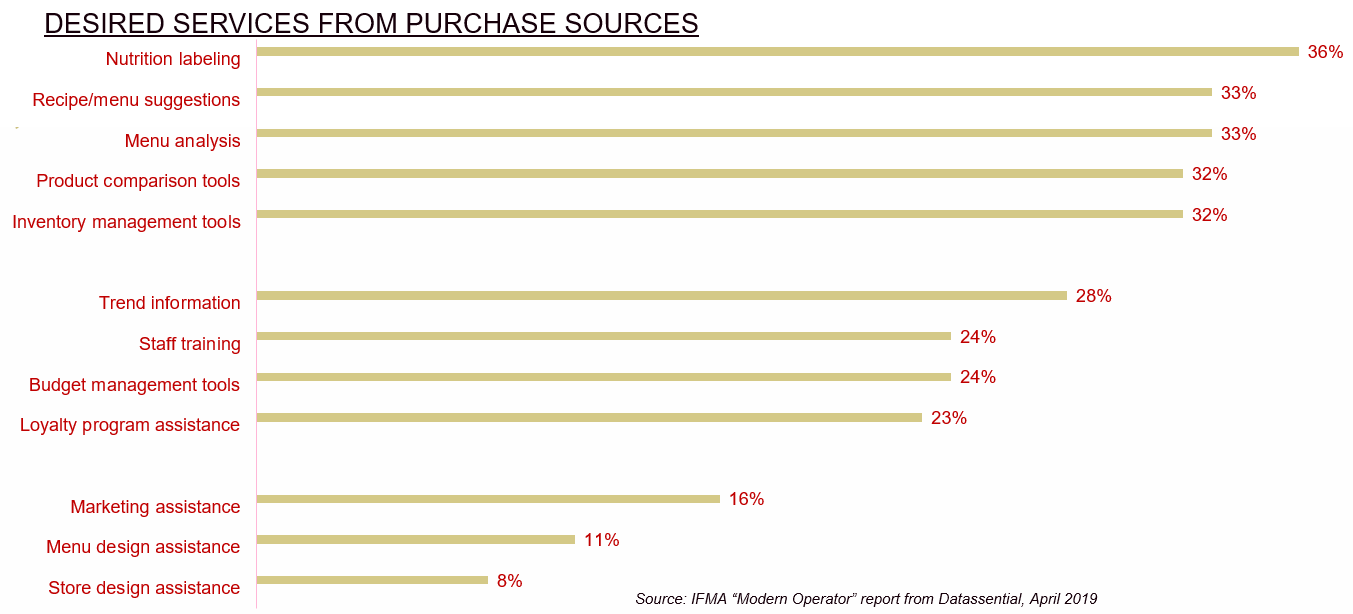

Providing value to the operator, beyond product, has often been referred to as “value adds” and are meant to provide a better partnership between the foodservice manufacturer and operator. However, it’s rare to find a “value add” that has truly driven incremental, long-term growth for a foodservice manufacturer. The trap many manufacturers fall into is investing in these services and then trying to find operators that want the new service. Truly understanding what value-added services an operator wants and can actually use is difficult. In fact, research from “The Modern Operator” report tells us that most operators are not looking for any services from their suppliers.

Among those operators that are open to using value added services, the ones they most desire are based around nutritional information, menus, and recipes. From the list below, determine which services, if any, your company can deliver with expertise and seamlessly to your operator customers. Then build the service to be different from a similar offering from your competitors.

With such small windows to influence an operator’s purchase decision, its incumbent on the foodservice manufacturer to find other means, outside of product and price, to make an operator buy your products. But, approach this tactic strategically by bringing a solution to the operator that they really need and can use.

To learn more about the motivations and triggers that influence foodservice operators’ buying habits, click here or contact Charlie McConnell more details.